When exploring high-level investment opportunities, few names carry as much weight as Citadel. The firm is a powerhouse in the financial world, but gaining entry into its exclusive funds is not a simple process. Many aspiring investors wonder about the Citadel minimum investment and what it takes to get a seat at the table. This guide breaks down everything you need to know about investing with this industry giant.

We will explore the structure of Citadel, its investment requirements, and who is eligible to participate. You will also learn about potential alternatives if direct investment isn’t the right fit for you. Understanding these key points is the first step toward navigating the world of elite hedge funds.

What is Citadel? A Tale of Two Firms

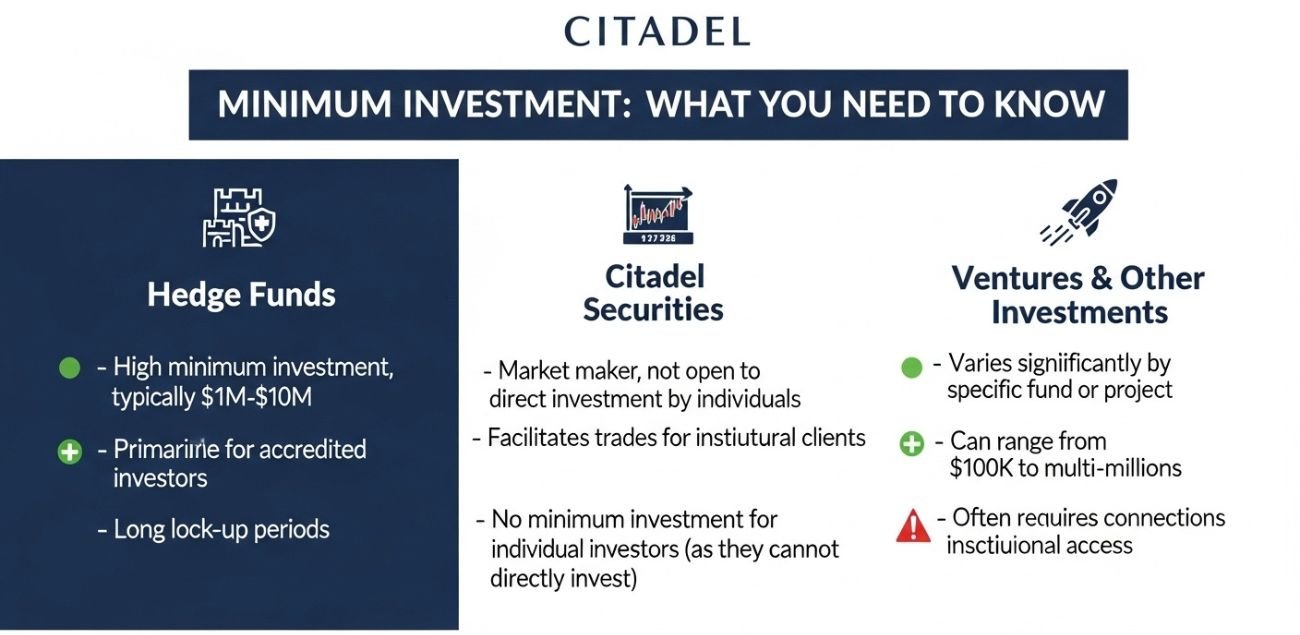

Before diving into investment thresholds, it’s crucial to understand that “Citadel” often refers to two distinct but related entities founded by Ken Griffin.

Citadel LLC

This is the globally recognized hedge fund. Founded in 1990, Citadel LLC manages capital for a select group of sophisticated clients. It uses complex, multi-strategy investment approaches across various markets, including equities, commodities, and fixed income. When people discuss investing in Citadel, they are typically referring to placing their capital into one of the funds managed by Citadel LLC.

Citadel Securities

This is a separate company that functions as a leading global market maker. Citadel Securities provides liquidity to financial markets, meaning it facilitates trading by being ready to buy or sell securities at any given time. It plays a vital role in the plumbing of the financial system, executing a massive volume of trades daily. You don’t directly “invest” in Citadel Securities in the same way you would a hedge fund; rather, it’s a key player in the market infrastructure.

For the purpose of this article, our focus is on the investment requirements for Citadel LLC’s hedge funds.

Understanding the Minimum Investment for Hedge Funds

Hedge funds like Citadel operate in a different league than mutual funds or ETFs that are available to the general public. They cater to a specific class of investors and, as such, have significantly higher barriers to entry. The hedge fund minimum investment is often substantial, and Citadel is no exception.

While Citadel does not publicly advertise its exact minimum investment, industry standards for premier hedge funds of its caliber typically start at $1 million and can go much higher, often reaching $5 million, $10 million, or more.

Several factors influence these high minimums:

- Exclusivity: High minimums ensure the fund works with a smaller, more manageable number of sophisticated investors.

- Strategy Complexity: The advanced trading strategies employed require significant capital to be effective.

- Operational Costs: Managing a top-tier hedge fund involves immense overhead, from technology to top talent.

- Regulatory Framework: These funds are designed for investors who have the financial capacity to withstand significant risk, a criterion often measured by net worth and investment size.

Who Can Invest in Citadel? Investor Eligibility

Beyond having deep pockets, you must meet specific legal and regulatory criteria to invest in a hedge fund like Citadel. In the United States, this primarily means qualifying as an “accredited investor” or a “qualified purchaser.”

Accredited Investor Requirements

The SEC defines an accredited investor as an individual who meets at least one of the following conditions:

- Has an individual or joint net worth with a spouse exceeding $1 million (excluding the value of the primary residence).

- Earned an individual income of over $200,000 (or $300,000 joint income with a spouse) in each of the two most recent years, with a reasonable expectation of the same for the current year.

- Holds certain professional certifications, designations, or licenses in good standing (such as Series 7, 65, or 82).

Qualified Purchaser Criteria

Many top hedge funds, including those managed by Citadel, require investors to meet the even stricter “qualified purchaser” standard. A qualified purchaser is generally:

- An individual with at least $5 million in investments.

- A family-owned company with at least $5 million in investments.

- A trust with at least $5 million in investments.

- An entity that, in aggregate, owns and invests on a discretionary basis at least $25 million in investments.

These institutional investor criteria and high-net-worth thresholds ensure that only those who are financially sophisticated and capable of absorbing potential losses can participate.

Alternatives to Investing Directly in Citadel

For most people, a direct investment in Citadel is out of reach. However, there are numerous other ways to access high-net-worth investment opportunities and alternative investment strategies.

- Funds of Funds: These are mutual funds or hedge funds that invest in a portfolio of other hedge funds. They often have lower minimums than direct investment and provide instant diversification, though they come with an extra layer of fees.

- Liquid Alternative Mutual Funds & ETFs: These are publicly traded funds that aim to mimic hedge fund strategies (like long-short equity or global macro). They offer daily liquidity and much lower minimum investments, making them accessible to retail investors.

- Other Hedge Funds: Citadel is at the apex of the industry, but thousands of other hedge funds exist. Many smaller or emerging funds have lower minimums, sometimes in the range of $250,000 to $500,000, for accredited investors.

- Private Equity & Venture Capital: For those interested in alternative investment funds, private equity and venture capital offer another avenue. These also require accredited investor status but focus on long-term investments in private companies rather than public markets.

Risks and Considerations of Hedge Fund Investments

Investing in a hedge fund carries a unique set of risks that differ from traditional stock and bond investing.

- High Fees: Hedge funds typically operate on a “2 and 20” fee structure, meaning they charge a 2% management fee on assets and take 20% of any profits. These high hedge fund fees and risks can significantly impact returns.

- Lack of Liquidity: Unlike stocks, your capital may be locked up for a specific period (e.g., one to three years). Withdrawals are often restricted to quarterly or annual windows.

- Complexity and Lack of Transparency: The strategies can be highly complex and opaque. Investors receive limited information about the specific holdings and trades.

- Market Risk: Despite sophisticated strategies, hedge funds are not immune to market downturns and can experience substantial losses.

Conclusion: Is a Citadel Investment Right for You?

The allure of investing with a top-tier firm like Citadel is undeniable. However, the path is reserved for a select few who meet stringent financial and regulatory requirements. The Citadel minimum investment is substantial, likely running into the millions, and is exclusively available to accredited investors and qualified purchasers.

For everyone else, the financial world offers a growing number of accessible alternatives that provide exposure to similar strategies without the prohibitive barriers to entry. Whether you explore funds of funds, liquid alts, or other financial market investments, the key is to perform thorough due diligence. Always consider your risk tolerance, investment horizon, and consult with a qualified financial advisor before making any decisions.

Frequently Asked Questions (FAQs)

Q1: What is the minimum investment for Citadel?

A1: Citadel does not publicly disclose its minimum investment. However, based on industry standards for elite hedge funds, the minimum is estimated to be at least $1 million and is likely significantly higher, potentially $5 million or more, depending on the specific fund and investor type.

Q2: Who can invest in Citadel?

A2: Investment in Citadel’s hedge funds is limited to highly sophisticated investors. You must typically meet the SEC’s criteria for an “accredited investor” and, more likely, the even stricter standard of a “qualified purchaser,” which requires a minimum of $5 million in investments for an individual.

Q3: Can I invest in Citadel Securities?

A3: Citadel Securities is a private company and a market maker, not a fund for outside investors. Therefore, the general public cannot invest directly in Citadel Securities in the same way they would a publicly-traded company or a hedge fund.

Q4: Are there any low-cost alternatives to Citadel?

A4: Yes. For investors who do not meet the high minimums, there are “liquid alternative” mutual funds and ETFs that aim to replicate hedge fund strategies. These are available to the public with very low investment minimums. Funds of funds are another option, though they come with higher fees than liquid alts.

Q5: What kind of returns can I expect from a hedge fund like Citadel?

A5: Top-tier hedge funds like Citadel are known for aiming to produce strong, risk-adjusted returns that are not correlated with the broader market. However, past performance is not indicative of future results, and all hedge fund investments carry a significant risk of loss. Their specific returns are proprietary and only disclosed to their investors.